As I say, it’s one of the safest professions you can ever choose to enter, and more so now than at any other time – hence the need for this depth guide. It’s not just politicians who want to change things, it’s the public as well. So it won’t be long before the crackdown comes not just for all schemes, but also for smaller businesses too. It is no longer publicly acceptable for large corporations to use tax avoidance schemes. But the problem with that solution is the increased cost.

Every time I picked up the phone and gave someone my email address I had to explain “that’s accountz with a z not an s”. This is because the tax legislation of every country far outweighs the amount of knowledge needed to operate a double-entry bookkeeping system. So it’s the bookkeepers who really know what’s going on. And understanding what that budget might be just also happens to be a part of the bookkeepers set of skills. We’ll get to that later on, but for now, you will be able to see just how important the time to reverse impairment losses on non work of a bookkeeper really is. Introductory accounting does not change often so future updates should be minimal.

More commonly, entrepreneurs use comprehensive accounting software like QuickBooks that can handle a larger volume of transactions and provide a deeper analysis. QuickBooks Live Expert Assisted can help you streamline your workflow, generate reports, and answer questions related to your business along the way. One of the most important aspects of financial transactions is recording them accurately. This involves keeping track of all the money that comes in and out of a business. The first step you’ll need is a business bank account, which allows you to keep your personal and business expenses separate. Bank accounts allow businesses to safely store their money and make transactions easily.

İçindekiler

QuickBooks Support

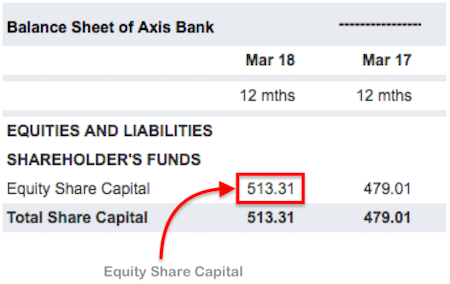

They can’t do that without looking into things like revenue, cash flow, assets and liabilities, which they’ll search for on your balance sheet, income statement and statement of cash flows. The two key accounting systems are cash accounting and accrual accounting. If your business is still small, you may opt for cash-basis accounting.

Beginning with the foundational introduction to what accounting is through the full accounting cycle, while including financial statement analysis towards the end of the book. Students will find the format helpful; the voice is student-friendly. Instructors will find the text format friendly to semester-long class as concepts broken down into 13 chapters. The chapters explain the learning outcomes, use examples to express concepts, with chapter summary at end. The topics included are consistent with intro accounting courses. This is the first course in a series of four that will give you the skills needed to start your career in bookkeeping.

What you need to set up small business bookkeeping

The content of this textbook matches the content and organization of most introductory financial accounting textbooks. It is written by Canadian authors, but is relevant to US students. The records of these events are then summarized into the primary financial statements. The numeric subtotals and totals on these statements are used to calculate standard financial measures and ratios used to evaluate the organization’s performance. The text’s organization then proceeds sequentially through the balance sheet accounts, explaining in more detail how the accounting for each category of economic value is recorded and reported. The author’s decision to move the most complex content to the end of the book matches how most faculty choose to organize their coverage of these topics.

The Definitive Free Guide To Bookkeeping For Beginners

- The table of contents essentially mirrors the table of contents found in the leading texts in this field.

- We asked all learners to give feedback on our instructors based on the quality of their teaching style.

- The bookkeeping transactions can be recorded by hand in a journal or using a spreadsheet program like Microsoft Excel.

- It only works if your company is relatively small with a low volume of transactions.

- After the cash account, there are the inventory, receivables, and fixed assets accounts.

These accounts and their sub-accounts make up the company’s chart of accounts. Assets, liabilities, and equity make up the accounts that compose the company’s balance sheet. Companies also have to set up their computerized accounting systems when they set up bookkeeping for their businesses. Most companies use computer software to keep track of their accounting journal with their bookkeeping entries. Very small firms may use a basic spreadsheet, what the cost principle is and why you need to know it like Microsoft Excel. Larger businesses adopt more sophisticated software to keep track of their accounting journals.

The Accounting Cycle (Part

Instructor aids include an exam bank, lecture slides, and a comprehensive end-of-term case assignment. This requires students to prepare 18 different year-end adjusting entries and all four types of financial statements, and to calculate and analyze 16 different financial statement ratios. Unique versions can be created for any number of individual students or groups. Bookkeepers how to use financial reports to calculate the number of days in accounts payable record and classify financial transactions, such as sales and expenses.