Because the places you to definitely deal with Samsung Handbag are way too of numerous to number, the brand new famous different is Walmart, and therefore doesn’t undertake Wallet or Google Spend. Please do note that pay by the mobile phone is not necessarily the exact same because the “PaybyPhone” which is an on-line parking percentage solution obtainable in a handful from nations. Shell out because of the mobile phone here relates solely; so you can internet casino costs with your cellular telephone expenses. He extra if the real cards gets taken, really don’t need a great pin for faucet transactions, to a specific limitation. You can also establish a good PIN having Meta Pay for more protection whenever giving costs by visiting Orders and you will Money settings.

İçindekiler

- 1 Subscribe In my Korea: Ming Dynasty $1 deposit

- 2 Applying for PayPal Borrowing from the bank

- 3 What’s the difference between Fruit Pay and you may Apple Pay Afterwards?

- 4 Utilizing Spend by Cellular telephone – The basics

- 5 Whenever must i maybe not have fun with shell out from the cellular telephone to have local casino repayments?

Subscribe In my Korea: Ming Dynasty $1 deposit

Centered on their capture-family pay and continuing expenditures, it will help to find out exactly how much you really can afford in order to charges so you can credit cards monthly. You will need to stick to a budget to help you pay off the balance completely and get away from focus. When you plan in the future, you’re also more likely to shell out your credit card bills timely.

Even though you play with a credit card you to definitely earns dos% cash back to your all the sales, you’d need to invest $1,250 per month to make $25 inside cash back. There aren’t any T-Mobile plans that come near to charging anywhere near this much, therefore in this case, skipping the financing card and opting for the fresh autopay dismiss is perhaps the right play. Catch up to the CNBC Select’s inside the-depth publicity from credit cards, banking and currency, and you can realize us to the TikTok, Myspace, Instagram and Twitter to stay high tech. Of a lot significant credit card issuers today along with let you request at random produced digital cards amounts to help cover oneself when shopping on line.

Applying for PayPal Borrowing from the bank

If the all these standards is came across, your cellular telephone is able to make contactless payments. To provide an identical credit or notes for the Apple View, utilize the Watch app. Check out the My personal Check out loss and you will faucet on the Handbag & Fruit Pay solution. This may give your own wearable a similar strength as your actual card, so that you’ll manage to pay together with your smartwatch even if their iphone isn’t nearby. To the credit picked, ensure the name thru Contact ID, Deal with ID or the passcode. Next, hold their new iphone 4 or Apple Observe close to the fee terminal in order to start the fresh fee.

Cellular wallets brighten the weight a small because you can access your entire credit cards without the need to hold for every one to you. And also this reduces the problems out of replacement in case of losses or theft. As soon as your cards are regarding your mobile handbag, your need the ability to purchase orders which have a smartwatch which is synced to your portable. Particular significant cellular company, including T-Mobile, features got rid of the fresh autopay dismiss if you utilize a charge card. When it comes to those occasions, you might be best off using together with your debit credit or via withdrawal out of a bank checking account.

- As you never withdraw your earnings in the same way your put that have Shell out because of the Mobile, you should use their other well-known fee solutions to cashout.

- The newest editorial content in this article isn’t provided with people of one’s businesses mentioned possesses perhaps not started examined, accepted if not endorsed because of the some of these organizations.

- Score instant access to participants-only issues, a huge selection of savings, a free of charge 2nd membership, and you can a subscription to help you AARP the fresh Mag.

- While using the a software, such as one for selecting dinner otherwise a journey-express service, you could potentially choose to make use of your Digital Handbag while the payment option.

- In the eating, cafes, and you can hotels, tipping isn’t requested and can actually be frowned-upon since the it’s up against Korea’s conventional society.

What’s the difference between Fruit Pay and you may Apple Pay Afterwards?

For every bundle otherwise IRA provides specific regulations and you may Ming Dynasty $1 deposit advice due to their people to adhere to. People and you will properties one live or provides a business in every one of those localities be eligible for taxation relief. A similar relief might possibly be accessible to most other says and you will localities one receive FEMA disaster declarations linked to Hurricane Helene. The modern listing of eligible localities is obviously available on the new Tax rescue in the emergency items page to your Internal revenue service.gov. You’re today making AARP.org and you may gonna an internet site . that is not work from the AARP. Rating immediate access in order to professionals-just issues, numerous deals, a free 2nd membership, and you may a registration to help you AARP the brand new Mag.

Utilizing Spend by Cellular telephone – The basics

Per app’s options techniques will be a tiny various other, however they will be permit you particular adjustment, including tips, invoices, and you may buyers loyalty system signups. But reporting the brand new con for the issuer, freezing a current cards, purchasing another one and then altering all of your autopay membership to an updated cards amount? Here’s what to understand to curb your sensitivity so you can con whenever to make payments this way. We feel group will be able to build financial behavior that have believe. You wear’t have to tip-in Korea and this they’s not required to carry any money to possess tipping.

Away from chatting to transport software to help you health overseeing, we’re also playing with our very own cell phones more info on to manage day-to-time lifestyle. That it’s no surprise that we’ve viewed a proliferation of cellular costs programs lately. A great 2020 Accenture Operating The ongoing future of Repayments Declaration unearthed that 68% from Gen Z ındividuals are trying to find quick people-to-individual repayments – more any age bracket. Technology you to underpins cellular handbag money is one thing entitled NFC, and this represents “near profession correspondence”.

The ability of manipulating a person to pay confidential guidance, personal technology is situated smaller so on application hacking and very to your fallibility out of humans. A guy you may slip target for the operate giving its credit card guidance to help you an internet site they feel to be dependable, but that’s indeed create just as the a system. Once you have extra a bank account, and everything is verified, you could potentially find Move into Lender at the top of the brand new Apple Bucks settings. Go into the number we would like to import and you may strike Close to fill in the brand new transfer. To start giving and getting payments, everything you need to perform try fool around with iMessage.

This article strolls you as a result of all you need to understand mobile repayments—of cellular currency transmits so you can simple tips to deal with NFC cellular repayments at the business. Fruit Spend are an assistance you to definitely lets you create cellular sales utilizing your established credit cards. Only stream your own credit cards to the Apple Wallet application on the their new iphone 4, and complete sales within the seconds instead ever pulling your own wallet otherwise playing cards out of your pouch. You don’t need to bother about card skimmers whenever everything is electronic, and it’s tough to fool face recognition and you will fingerprint technical.

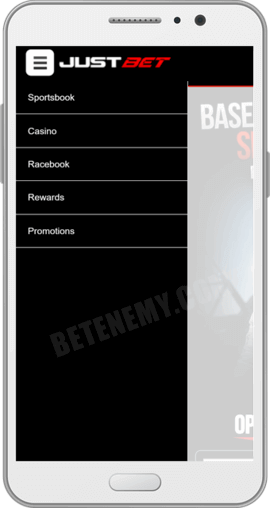

Whenever must i maybe not have fun with shell out from the cellular telephone to have local casino repayments?

Unlock the brand new Wallet app by the swiping right up from the bottom out of the newest monitor (when you yourself have Immediate access let) otherwise looking they on your software case. Find the card you want to spend that have, make use of your fingerprint or PIN to confirm, and you will hold the mobile phone near the NFC-enabled terminal to accomplish the transaction. From the eating plan tab, tap for the Percentage notes, get the cards we want to remove and you can tap to the around three straight dots symbol to open up far more alternatives. Try to go into the Wallet PIN otherwise have fun with biometrics so you can remove the brand new card. Its not necessary to install otherwise down load one kind of software to complete a wages by the cell phone purchase. Particular telecom providers provides enabled the choice on the programs, that you might use to display screen the impending debts, paying limitations, etc.

Discover Guide 547, Casualties, Catastrophes, and you will Thefts, to have details. On top of other things, because of this any of these components one to in the past acquired relief pursuing the Tropical Violent storm Debby usually have those work deadlines subsequent defer so you can Can get 1, 2025. Simultaneously, the brand new Internal revenue service is also getting punishment rescue so you can companies that build payroll and you can excise income tax places. Fruit Spend Later on are technically a single-date mortgage, perhaps not a credit card. If you want to have fun with a different one, scroll through the listing and pick an alternative card. These types of services behave as a spin-between to include shelter amongst the individual financial suggestions and any would-become theft.